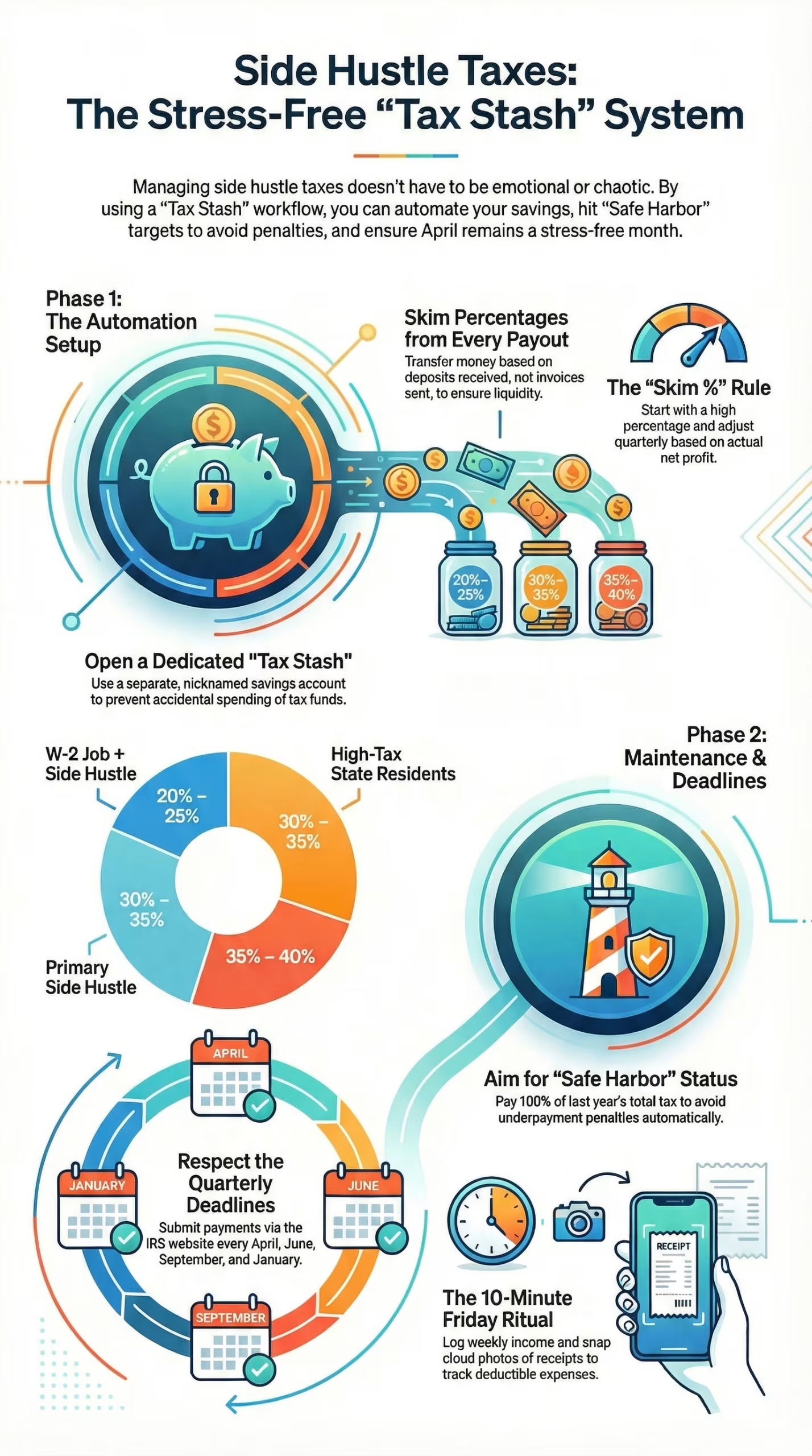

Making quarterly estimated taxes for your side hustle shouldn’t be a scary or daunting task. If you make freelance, creator, gig, or Etsy income alongside (or instead of) a W-2, a simple quarterly income tax workflow allows one to skim a small percentage from each payout to hit safe harbor rules, and se to pay on time without stress. I’m going to show you exactly how to set your Tax Stash, pick a realistic skim %, and schedule all four quarterly payments so April stays boring—in the best way.

This Tax Stash guide shows you how to set one up, calculate a safe-harbor target, choose what percentage to skim off which deposit, and don’t forget to pay it on time. We are going to discuss the combos of W-2 and side hustle, the deductions that really matter, and the quick fix if you are behind. No scare tactics. Just a calm workflow you can start today.

The Main Concept: MakeTaxes Automatic Not Emotional

Quarterly taxes are simply prepayments of your expected annual tax that are due on four dates. The easy way to win is to.

- Put some percentage of every side-hustle deposit into a separate Tax Stash savings account.

- Check your safe-harbor (so you don’t owe penalties).

- Pay out on the regular quarterly schedule (shifts to the next business day if the date lands on a weekend/holiday).

- Adjust the skim % once per quarter as your income shifts.

That’s it. You’ll pay taxes every time you are paid at work; you receive a bill, not a surprise in April.

Side Gig Tax Stacks: How Much You Actually Pay

As a sole proprietor and single-member LLC you likely owe

- Income tax (based on your taxable income after deductions).

- The self-employment tax on net profit goes to social security and Medicare.

- State/local tax (varies by where you live).

Your net profit or loss from your side venture equals the income minus any deductible expenses to generate that income. Your SE tax is calculated on a majority of that profit (except for a small built-in adjustment). The tax is different from the income tax, and that’s why side hustlers feel the hurt if they don’t skim as they go.

Pick Your Starting Skim % (so you’re never short) 🧮

You need a percentage that covers your self-employment tax, federal income tax, and typical state tax based on your situation. Use these starting ranges (tune quarterly).

- A W-2 job plus a small side hustle can result in earnings equal to 20 to 25 percent of the side-hustle’s net profit.

- A side hustle is a primary employment (no W-2 withholding) income of 30% to 35% of net profit.

- States between 35 to 40 per cent of net profits.

Start a touch high. If the stash increases faster, that’s great—whatever is left over after you file will stay with you. If it’s too low, you’ll top up next quarter.

Take money from deposits instead of invoices. Only money received is real. If your platform pays you out two to three times a week, your stash increases automatically.

Safe Harbor, Explained Like a Human 🛟

You can avoid the IRS underpayment penalty if you qualify for safe harbor. In practice, you won’t owe anything if you’ve paid in enough money.

- Either 100 percent of last year’s total tax or.

- If you earned more last year (often used for higher AGIs), you owe 110% of last year's total tax, or.

- You will finally owe 90% of the total tax of the current year.

The safeguard from the previous year, set by the IRS, is easy to use. Get the total tax of last year’s return, divide by four, and that’s your minimum. If this year is looking bigger, raise the skim % so you’re not running to catch up in Q4.

Your Stress-free Workflow (step by step) ✅

1. Open a Dedicated “Tax Stash” Savings 🏦

Nickname it “Quarterly Tax Stash” in your banking app. The name matters—it stops you from “borrowing” it.

2. Set an Auto-transfer Rule for Every Deposit 🔁

Whenever a payout lands in checking, automatically transfer your skim % to the stash. For example, your skim % might be 30%. Arrange for execution of sweep transaction on a weekly basis.

3. Track Net Profit Quickly (no fancy software) 📒

- Keep track of your transactions with the date, client, platform, amount in or out, and a small note.

- Store your invoices in one folder in the cloud; take a photo when you buy it.

- Create a separate account for business (easier to record).

4. Check Your Safe Harbor Once a Quarter 🧭

- Last year’s total tax ÷ 4 = minimum quarterly target.

- Compare to your stash balance before each due date.

- If stash < target, top up (or adjust skim % going forward).

5. Pay Online in Minutes 💻

Use the official online options provided by the IRS to send Quarterly Estimated Taxes under your SSN/EIN. Set up your payments to take place before the due date so you never need to think about it again.

6. Rinse, Eeview, Adjust ♻️

Each quarter review your YTD profit and adjust the skim % by 2–5 points up or down. You’ll dial it in within two cycles.

The Quarterly Schedule (bookmark this) 📆

Each year, there are estimated tax due dates that cover chunks of the year’s income, four in total. When a date occurs on a Saturday, Sunday or holiday, due date goes to the next business day. Add all four dates to your calendar along with two reminders, one a week prior and one the day before.

I have a reminder that I created called tax tap and it is set to recur on the first business day of each due-month. I glance at the stash, press pay, done.

Two ways to calculate your quarterly payment 🧠

Method A — prior-year safe harbor (easy mode)

- Look at your total tax from last year’s return (federal).

- If you are in the upper bracket category, you shall use its 110% variant.

- Choose four.According to your W-2 withholding on other income, use this figure if you want to fine-tune (optional).

- Pay the remainder by each due date.

It works because even if you end up with a bigger bill next April, you usually avoid underpayment penalties due to safe harbor.

Method B — current-year estimate (more precise)

- Estimate current-year net profit for the side hustle.

- Calculate your self-employment tax on that profit. Just use a basic SE calculator or your tax app to do that.

- Use your w-2 and side hustle earnings to estimate your taxable income for tax payment.

- Add expected state/local tax if applicable.

- Divide total by 4 → that’s your quarterly payment.

You’re paying in much closer to real and April is quiet. It might briefly take some time longer every quarter. But your stash instantly tells you whether you are on track.

Number series, cool math 🔢

Suppose that your side business earns you $24,000 in a year. You also have a W-2 with decent withholding.

- Start skimming 30% of your savings. That’s roughly $600 per month or $1,800 a quarter in your stash.

- Due to last year’s total tax being low, safe harbour may be $1,400 every quarter. You still have enough money to spend even at the end of the year.

- If your side gig sees mid-year growth once the income period is complete, your skim should also bump up to 33–35% so you don’t scramble in Q4.

Withholding hack for W-2 + side hustle

If you receive a W-2, you can raise your withholding for your paycheck to cover the taxes from your side-hustle. Request the HR department to modify your W-4 or to set a fixed amount for each paycheck. This is a wonderful option if your employer HR is fast and you are comfortable with one tax channel.

If your W-2 is the same as past years and your side hustle isn’t big, just withhold more at work and don’t bother with separate quarterlies. Having quarterly financials will keep your numbers cleaner if your side hustle varies a lot.

Deductions that actually move the needle ✂️

- Area of the house used regularly for business purposes. You can use either the square foot method or your actual expenses if you keep track.

- For business miles, you can pick between the standard mileage rate or actual costs. (Just use one method per year and vehicle, and keep a log).

- Phone & internet (business portion).

- Gear & supplies used for the business.

- fees that are ordinary and necessary for your business software and subscription

- Health insurance premiums (if self-employed and eligible).

- Save on taxes and save for you by contributing to a SEP-IRA or Solo 401(k).

Whenever you receive a receipt, make sure to take a photo of it. Store that photo in the same folder in your cloud as well. A mantra that is sorta harsh, but effective is “If it wasn’t saved, it didn’t happen.”

1099 forms, platforms, and do I report it? 📄

Always report any additional income you may earn from a side hustle—even if the income is small or you don't receive a 1099. Your clients may issue you a 1099-NEC for services. Certain payment platforms may issue 1099-K forms, if thresholds are met.

Generally speaking: money that comes in is income, unless a specific rule says otherwise.

Fell behind? Here’s the calm catch-up plan 🧯

- Pay something this quarter—anything—so you’re not at zero.

- Raise the skim % by 5 points for the rest of the year.

- If you are paid on a biweekly basis at your W-2, you will get paid three times for that month. Consider this three paycheck month to get a bucket started.

If you're still going to miss safe harbor, prepare for a little underpayment interest at filing, not a big deal, just fix the system for next year.

Bookkeeping That Takes 10 Minutes a Week ⏱️

- One business-only card/account.

- At the end of Friday, log your income and expenses, move the skim % to the stash, and snap any stray receipts.

- Update your year-to-date profit and and skim % every month.

- Every few months: check safe harbor, pay, breathe.

Tips, Tricks, Hacks & Local Secrets 🧠

- The skimmed funds are divided into two

- federal and state

- with the state getting the smaller slice of the pie at 30%.

- If your business provides cash tips, skim daily while counting out your drawer/envelope.

- When skimming, round up to the nearest $5. Those nickels and dimes add a silent cushion.

- Use a calendar stacked with reminders for your tax dues and a backup reminder on the first business day of each due month.

- Give your money a name; if your stash transfer says “Q1/Q2/Q3/Q4 — Federal/State,” it usually gets spent on that.

- Quarterly review ritual: New client? New rate? It makes sense to add 2 points to skim for the next quarter till things settle.

- Save the payment page to your phone favorites with one tap. Taxes get paid during coffee, not during panic.

- If your bank allows you to set rules, automatically skim an entire deposit and forget it.

- If you have a paycheck every two weeks, plan which three months of the year will be the best times to save money.

- When in doubt, be quiet in April. If your stash is positive after filing, roll that extra into Q1 of the next year.

Quarterly Estimated Taxes for Side Hustlers

What are quarterly estimated taxes for side hustlers, in plain English?

Do W-2 workers with a small side hustle have to make quarterly estimated tax payments?

How much should I save from each side-hustle payment for my quarterly estimated taxes?

What is the safe haven for freelancers to escape underpayment fines?

When are quarterly estimated tax due dates? What about weekends and holidays?

How to compute quarterly estimated taxes if income is seasonal (photographer, landscaper, etc.)?

How can you pay your quarterly estimated taxes online without making a mistake?

Can I cover side-hustle taxes by adjusting my W-2 withholding rather than paying quarterly?

What kind of bills can I deduct from my small business or creator brand?

Can I ignore estimated tax payments without a 1099-NEC or 1099-K in my hand?

How can I calculate self-employment tax and income tax for my side-hustle profit?

What’s the recommended bookkeeping routine for Uber drivers, Etsy sellers, freelancers for quarterly estimated taxes?

What should I do if I’m currently behind on my quarterly estimated tax payments?

Do I also need to make quarterly estimated tax payments at the state level for my side job?

Can I pay quarterly estimated taxes with a credit card?

Are home-office deductions safe for quarterly estimated tax planning?

How does quarterly estimated tax work if I don’t take on a side hustle until midway through the year?

If I have more income during the year, should I make equal quarterly estimated payments?

I’m confused about how to do my quarterly estimated taxes with my retirement contributions (SEP-IRA, Solo 401(k)).

What if I mistakenly pay too much in quarterly taxes for my side job?

What records do I need to keep in case of questions later?

As a freelancer, do I need to form an LLC to make quarterly estimated tax payments?

Final Thoughts 💬

Quarterly estimated taxes are not a mystery; they’re a practice. Choose a comfortable skim percentage, put your money in a specially named Tax Stash, only legally buy something that meets safe harbor, and carefully pay on the standard schedule. If you make a few tweaks every quarter, tax season will go from fearsome to a simple five-minute checklist.

Let your side hustle fund your future, not your stress. Just keep it automatic, keep it boring.

Comments (0)

No comments yet. Be the first to share your thoughts!

Leave a Comment